Crypterium token (CRPT). Subtoken of credit (CRPT: CRED)

Structure of tokens

Cost of 1 CRPT token: - 0.0001 BTC

Term of sale of tokens: - 75 days with the possibility of an automatic early termination in function of reaching the final objectives of the ICO

Objectives expanded after the start of the ICO: - Impossible

Technical limitation of the number of tokens: - 300,000,000

Adjustable issue: - All tokens not sold and not assigned will be deinked and an additional issue of tokens will not be possible

Secure ways to buy tokens: - Bitcoin (ВТC), Ethereum (ETH), payments in trust money

Launching of the list of tokens in the exchange sites after the end of the ICO: - Not before one month and not after two months

Cryptobank leader for cryptoeconomics

Crypterium's objective is to provide a complete vertically integrated service that encompasses the best ideas of the entire world community of blockchain enthusiasts.

CRPT - "COMBUSTIBLE" of Crypterium transactions

For each transaction, 0.5% of that transaction, in CRPT tokens, is "burned" forever. The "burning process" is regulated in a decentralized way by intelligent contracts. The amount of 0.5% will be calculated based on the exchange rate in effect at the time of the transaction.

The CRPT tokens issued during the ICO are the only tokens that Crypterium will emit. No CRPT tokens will be issued after the ICO.

The only guaranteed way to use Crypterium settlements and buy CRPT tokens for a fixed price is to buy the tokens during the ICO. Users who do not have tokens should buy CRPT tokens from the token holders, to use the revolutionary banking features of Crypterium. Crypterium aims to list its token in exchange houses after the ICO to support and expand its user base

CRPT supports its users and holders of tokens

30% of the transactional income of Crypterium forms the Monthly Loyalty Fund (MLF), designed to stimulate tokens and users to actively use the cryptobank, and also to reward especially active users (similar to reimbursements). Loyalty rewards are made in CRPT tokens that Crypterium buys in public and private exchange houses according to the exchange rate in effect at the time of purchase.

The rewards for fidelity of each user depend only on the amount of the transactions that he / she has made in the services of Crypterium during that month.

Credit system technology based on blockchain

The credit sub-loan (CRPT: CRED) provides the opportunity to create a complete bank structure and interest interactions based on blockchain.

Go to the profile of Ron Job

Ron JobFollow

Dec 2, 2017

Crypterium token (CRPT). Subtoken of credit (CRPT: CRED)

Structure of tokens

Cost of 1 CRPT token: - 0.0001 BTC

Term of sale of tokens: - 75 days with the possibility of an automatic early termination in function of reaching the final objectives of the ICO

Objectives expanded after the start of the ICO: - Impossible

Technical limitation of the number of tokens: - 300,000,000

Adjustable issue: - All tokens not sold and not assigned will be deinked and an additional issue of tokens will not be possible

Secure ways to buy tokens: - Bitcoin (ВТC), Ethereum (ETH), payments in trust money

Launching of the list of tokens in the exchange sites after the end of the ICO: - Not before one month and not after two months

Cryptobank leader for cryptoeconomics

Crypterium's objective is to provide a complete vertically integrated service that encompasses the best ideas of the entire world community of blockchain enthusiasts.

CRPT - "COMBUSTIBLE" of Crypterium transactions

For each transaction, 0.5% of that transaction, in CRPT tokens, is "burned" forever. The "burning process" is regulated in a decentralized way by intelligent contracts. The amount of 0.5% will be calculated based on the exchange rate in effect at the time of the transaction.

The CRPT tokens issued during the ICO are the only tokens that Crypterium will emit. No CRPT tokens will be issued after the ICO.

The only guaranteed way to use Crypterium settlements and buy CRPT tokens for a fixed price is to buy the tokens during the ICO. Users who do not have tokens should buy CRPT tokens from the token holders, to use the revolutionary banking features of Crypterium. Crypterium aims to list its token in exchange houses after the ICO to support and expand its user base

CRPT supports its users and holders of tokens

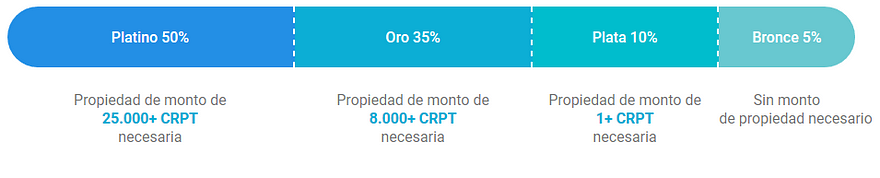

30% of the transactional income of Crypterium forms the Monthly Loyalty Fund (MLF), designed to stimulate tokens and users to actively use the cryptobank, and also to reward especially active users (similar to reimbursements). Loyalty rewards are made in CRPT tokens that Crypterium buys in public and private exchange houses according to the exchange rate in effect at the time of purchase.

The rewards for fidelity of each user depend only on the amount of the transactions that he / she has made in the services of Crypterium during that month.

Credit system technology based on blockchain

The credit sub-loan (CRPT: CRED) provides the opportunity to create a complete bank structure and interest interactions based on blockchain.

Example

The total income of Crypterium during the month was $ 5,000,000, of which $ 1,500,000 was used to buy tokens and feed the refunds fund.

The distribution will occur as follows: imagine that in the platinum group there are 1,000 token holders, who made total transactions for $ 1 million. At the same time, one of the token holders made a single transaction of $ 10,000, which therefore represented 1% of the total volume of group transactions. This means that you will receive 1% of the volume of the token fund in CRPT tokens, which in terms of dollars will be about 7,500 dollars. This motivates the token holders to make more transactions.

1.Credit

A customer receives a Crypterium Credit CRT: CRED, backed by an intelligent contract that takes into account the credit rating of that specific customer and in turn applies the client's specific conditions (which may or may not include a guarantee) and their specific interest rates.

2. Currency exchange

The client then converts the loan to the currency of his choice in a dedicated currency exchange within Crypterium. This is done transparently within Crypterium at the request of the client.

3.100% Guaranteed

Liquidity is guaranteed by Crypterium, which will use its capital to reduce volatility and adjust interest rates. You can also link the credit itself to the index of a world currency to avoid sudden fluctuations.

4.Recompra

At the end of the loan period, the borrower must repay in CRPT: CRED including the interest, buying the cryptocurrency in the CRPT: CRED monetary exchange.

5. Debt cancellation

The borrower has now completed his payment obligations and corrected his credit rating for future loan applications

6. Demand

The cycle of cryptocurrency to fiduciary money and vice versa creates an inherent need for services based on Crypterium and ultimately a greater demand for CRPT: CRED

The credit subtoken is a new standard

of cryptocredit based on blockchain

The first subtoken with assured liquidity

Owners of credit subtokens receive much higher income than the market average

Decentralized storage of reputation of borrowers in smart contracts

Opportunity of other cryptobanks to use CRPT: CRED

Details Information:

Website: https://crypterium.io/

Twitter: https://twitter.com/crypterium

Facebook: https://www.facebook.com/crypterium.io

Author: (specsmuluk) https://bitcointalk.org/index.php?action=profile;u=1062194

Tidak ada komentar:

Posting Komentar